time:2023-01-11

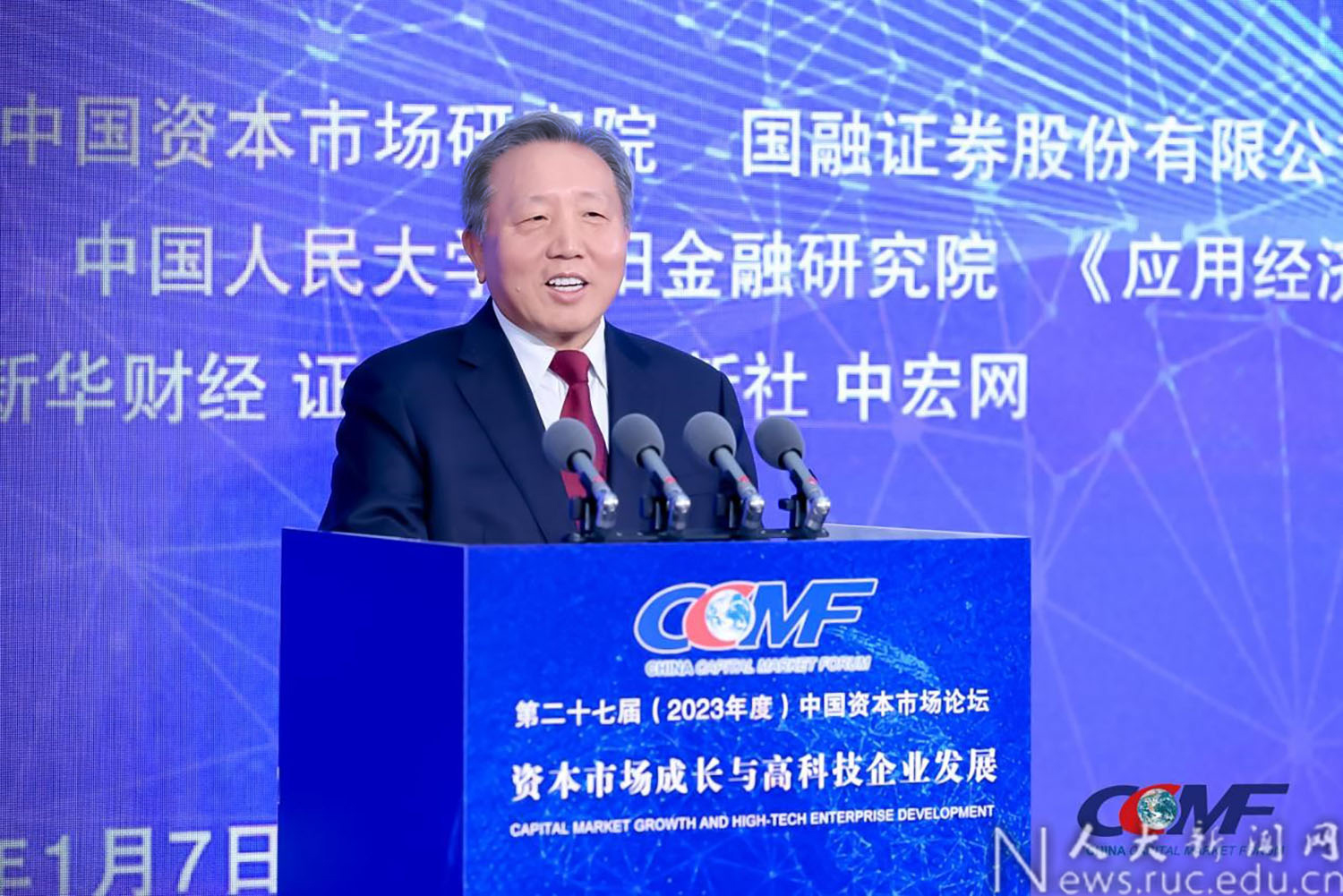

The 27th (2023) China Capital Market Forum was held on Jan 7, co-hosted by the Research Institute of Capital Market of Renmin University of China (RUC) and Guorong Securities Co., Ltd., with special support from the School of Finance, the Chongyang Institute for Financial Studies of RUC, and the editorial department of Applied Economics Review.

The theme of the forum is “Capital Market Growth and High-Tech Enterprise Development”. Leaders, experts, and scholars from central state agencies, universities, research institutions, and other relevant units, as well as guests from the industry, gathered together to discuss the past and future of the capital market, the new model of the financial system, and the development path of high-tech enterprises.

Zhang Donggang, Chairperson of the University Council, RUC, delivered an opening speech during the opening ceremony. Zhang Zhihe, President of Guorong Securities, delivered a welcome speech. The opening ceremony was presided over by Zhuang Yumin, Dean of the School of Finance, RUC.

Zhang Donggang said that the Forum is one of the important academic brands of RUC and has made contributions to the healthy development of China's capital market. Themed “Capital Market Growth and High-Tech Enterprise Development”, it would help promote the reform of China’s capital market and the construction of a multi-level capital market, modern financial system, and modern industrial system. He hoped that the Forum, as an important academic innovation field of RUC, could promote the research and development of financial disciplines and capital markets, providing high-level intellectual support for China’s financial regulatory agencies, financial research institutions, and financial industry institutions.

Zhang Zhihe emphasized the importance of technological innovation. He pointed out that the new round of scientific and technological revolution and industrial transformation are the key variables in the world today, becoming the main battlefield of the game of great powers, and also crucial aspects after China entered a new stage of development.

Zhuang Yumin said that the purpose of this forum is to jointly discuss the growth of the capital market and the development of high-tech enterprises and offer advice and suggestions for the development of China's capital market and modern industrial system. He believed that the Forum would bring new collisions of ideas like every previous one.

Ning Jizhe, Vice-chairman of the Committee on Economic Affairs of the National Committee of the Chinese People’s Political Consultative Conference (CPPCC), Jiao Jinhong, Chief Lawyer of the China Securities Regulatory Commission, Gao Peiyong, Vice President and member of the Chinese Academy of Social Sciences, and Gao Xiqing, Professor of the School of Law, University of International Business and Economics, delivered keynote speeches respectively. Wu Xiaoqiu, Dean of the Research Institute of Capital Market, released a keynote report. This session was presided over by Wang Wen, Executive Dean of the Chongyang Institute for Financial Studies.

Ning Jizhe said that while new industries and new enterprises are growing rapidly, it should be seen that the recovery of the world economy has slowed down for some time and China’s economy is still facing great pressure. Domestic and foreign technology-based enterprises are also facing some new problems. He pointed out that improving social expectations and boosting confidence in development is a top priority. Turning technology-based enterprises into a fusion point and gathering place of innovation chains, industrial chains, capital chains, and talent chains will bring breakthroughs to China's industrial economy.

Jiao Jinhong emphasized the importance of building the rule of law in the capital market. He said that the capital market should be a market guided by the rule of law. Promoting the construction of the rule of law in the capital market with Chinese characteristics is an undertaking facing theoretical and practical challenges. He said that the China Securities Regulatory Commission will continue to promote the construction of the rule of law in the capital market with Chinese characteristics.

Gao Peiyong gave three suggestions. First, scholars who study macroeconomic policies should focus on costs. Secondly, macro policy choices must be based on not jeopardizing financial security, especially regarding financial security as the last line of defense for all security. Finally, the expansion of fiscal policy and monetary policy can’t solve all problems.

Gao Xiqing pointed out that we should not forget our original intention, respect common sense, and respect rules. First of all, the original intention of the capital market is to adhere to marketization, rule of law, and internationalization. Secondly, respecting common sense means respecting the role of the market, and all trading entities must be treated equally. Finally, respecting the rules means that market entities must not only abide by the rules, but also government regulators must respect the rules. Let investors play games with each other, and let the people benefit.

Wu Xiaoqiu released a keynote report entitled The Logic of Capital Market Development: Financial Innovation Coupling with High-tech Enterprises and made a speech. He said that the future of finance lies in disintermediation and technological progress. Structural changes in finance are caused by disintermediation, while competitiveness and vitality come from technological progress. He emphasized that China's financial reform has stepped out of an integrated model, which is very gratifying.

Wang Wen said that the Forum has been held for 27 consecutive years, full of big names and classic insights. He looked forward to more exciting sparks of thought bursting out at this Forum.

Focusing on the theme of “Science and Technology Progress, Industrial Iteration and Capital Market Development”, senior professors and young scholars attending the conference conducted discussions. Wu Xiaoqiu and CCTV financial host Yao Zhenshan co-hosted the session.

The report to be released at this forum has been compiled into a book and published, entitled The Logic of Capital Market Development: Financial Innovation Coupling with High-tech Enterprises. The book attempts to analyze the logical relationship between the survival and development of the capital market, financial disintermediation, and industrial iteration based on technological progress from the perspective of historical and empirical analysis, and to find the logical basis and policy fulcrum for the survival and development of China’s capital market.